37+ 2020 estimated tax payment calculator

If youve already paid more than what you will owe in taxes youll likely receive a refund. This simple calculator can help you.

Ju7erska8qicym

Well calculate the difference on what you owe and what youve paid.

. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. The Payment Calculator can determine the monthly payment amount or loan term for a fixed interest loan. 37 2020 estimated tax payment calculator Kamis 01 September 2022 Edit.

It is mainly intended for residents of the US. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Calculate the amount of underpayment.

File 2020 Taxes With Our Maximum Refund Guarantee. Paystubs for all jobs. And is based on.

Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. This includes Oregons minimum tax. Your household income location filing status and number of personal.

Doing 2020 Taxes Online Makes It Easy. And is based on the tax brackets of 2021 and. Choose an estimated withholding amount that works for you Results are as accurate as the information you enter.

Use this federal income tax calculator to estimate your federal tax bill. 1040 Tax Estimation Calculator for 2020 Taxes Enter your filing status income. You must make quarterly estimated tax payments if you expect to owe 500 or more in tax.

Based on your projected tax withholding for the. What You Need Have this ready. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Estimate Federal Income Tax for 2020 2019 2018 2017 2016 2015 and 2014 from IRS tax rate schedules. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Calculate net income after taxes.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Use Form OR-37 to. To calculate your estimated taxes you will add up your total tax liability for the current yearincluding self-employment tax individual income tax and any other taxesand divide.

Quarterly Estimated Tax Calculator - Tax Year 2020 Use this calculator to determine the. Use your income filing status deductions credits to accurately estimate the. Ad Prior Year 2020 Tax Filing.

1040 Tax Estimation Calculator for 2020 Taxes Enter your filing status income deductions and credits and we will estimate your total taxes. If you expect to owe more than 1000 in taxes thats earning roughly 5000 in self-employment income then you are required to pay estimated taxes. See your tax refund estimate.

Find your total tax as a percentage of your taxable. Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax. All Available Prior Years Supported.

Use the Fixed Term tab to calculate the monthly payment of a fixed-term loan.

Trends In The Well Being Of America S Children And Youth 1997 Aspe

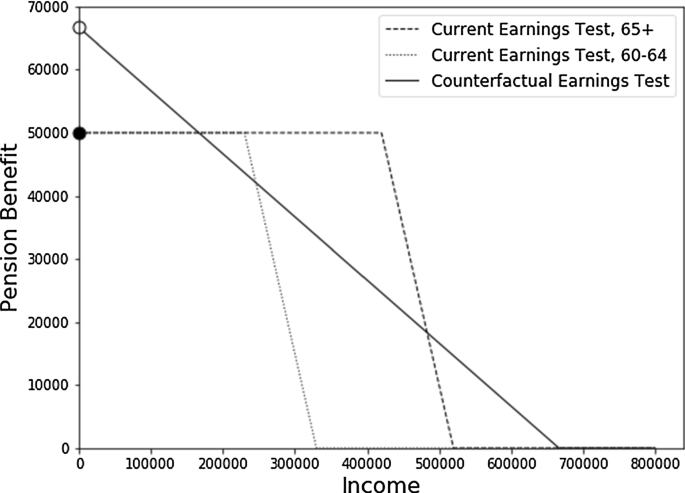

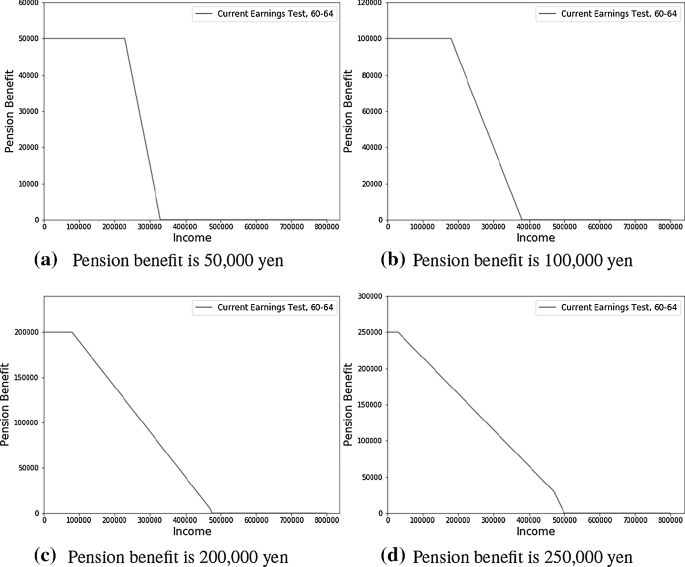

The Optimal Earnings Test And Retirement Behavior Springerlink

Women In The Workplace Cqr

Find Out Your Estimated Etsy Seller Direct Checkout And Paypal Fees Etsy Seller Fees Etsy Etsy Sales

Why Am I Seeing This Ad

Merger Prospectus Communication 425

Points To Consider While Buying A Term Insurance Plan Term Life Insurance Quotes Life Insurance Quotes Permanent Life Insurance

What Is The Difference Between Ferrari Having A Second Team And Red Bull Toro Rosso Quora

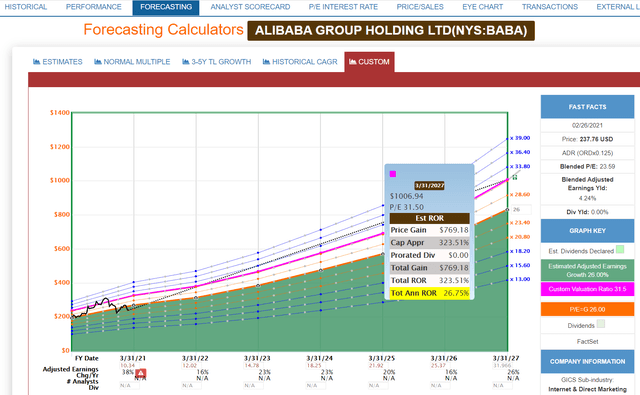

6 Reasons Alibaba Stock Is Too Cheap To Ignore Nyse Baba Seeking Alpha

Material Price Variance Calculator Financial Management Calculator Business Law

Hermes Losange Size Guide Cool Things To Make Hermes Hermes Scarf

The Optimal Earnings Test And Retirement Behavior Springerlink

Tax Deivas Llc Facebook

2

Tax Deivas Llc Facebook

Bob Jensen S Illustrations Of Critical Thinking

Management Page 3 The Bullvine The Dairy Information You Want To Know When You Need It